NOT ZERO: How ‘net zero’ targets disguise climate inaction

This joint briefing highlights concerns that many governments and corporations are jumping on the bandwagon and declaring "net zero" climate targets.

Extractive Sector Taxation

This progressive tax policy briefing explores how countries can optimize revenues from mining, oil and gas resources, and curb potential revenue loss from extractive industries.

Short-Changed: How the IMF's tax policies are failing women

In recent years the International Monetary Fund (IMF) and other multilateral institutions have placed an increased emphasis on gender inequality and the need to address it. This trend has peaked since

Attacks on Civic and Democratic Space

Laws and practices that restrict civil space and civil society's ability to operate are undermining people's ability to advance human rights, hold governments to account and help vulnerable

Youth, Gender and Social Protection

This paper is an excerpt from AAI’s preliminary report, Youth, Gender and Social Protection: Rebuilding systems for the 21st Century. It is written with a focus on young women and men, whose futures

Progressive Taxation Briefings

Progressive taxation means higher tax rates for people who earn or have more wealth and is a clear example of progressivity. The briefings cover generally-regressive taxes that can and should be

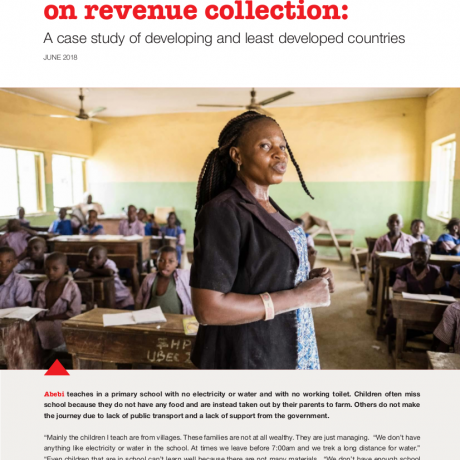

The impact of tax treaties on revenue collection: A case study of developing and least developed countries

Executive summaryForeign direct investment (FDI) by multinational enterprises is given substantial weight by an expanding number of developing countries. Many of them have decided to sign tax treaties

Protecting the labour rights of young workers

Strengthening legal protections against gender based violence at work is particularly important for young workers, 77% of whom are in informal employment.

Tax, Privatisation and the Right to Education Project

The Tax, Privatisation and the Right to Education project is a multi-country education and tax justice project funded by private donors.It brings together four countries working towards a common goal

Double jeopardy

Every day, women around the world are making an invaluable contribution to the global economy through paid and unpaid labour. Their work is often poorly paid, invisible and precarious due to