Tax, privatisation and the right to education

This report brings together participatory research carried out in Ghana, Kenya, Uganda and Pakistan as part of the Tax, Privatisation and Right to Education multi country project.

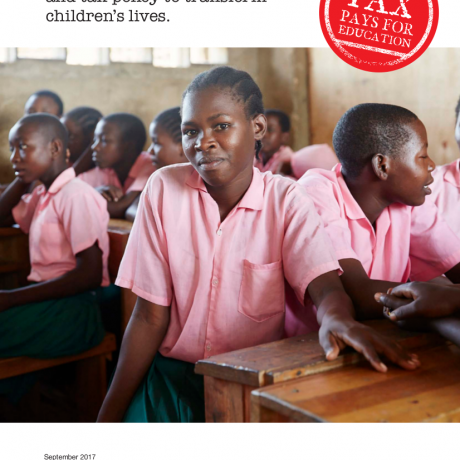

Making tax work for girls’ education

Globally, there are 264 million primary and secondary age children and youth out of school. More girls than boys currently receive no primary education and many pupils in school in developing

Mission Recovery: How big tech’s tax bill could kickstart a fairer economy

The world’s largest economies losing up to US$32 billion in annual tax revenue from Silicon Valley’s top five tech companies: Enough to vaccinate every human on earth.

The ActionAid Tax Justice Reflection Action Toolkit

Our tax justice reflection action toolkit (TJ-RATK) is made to help empower communities to stand up for their rights.

Over 18 million girls missing school in Africa as continent loses USD29 billion in education funding through flawed taxation

A staggering 18,8m girls are out of primary school in Africa according to a new report by the Tax and Education (TaxEd) Alliance and its allies.

Who Owes Who?

As we enter 2025, 54 countries are in debt crisis, forced to cut their spending on basic public services and climate action in order to pay external debts. Last year, lower income countries between

The Vicious Cycle

The countries that are most vulnerable to the climate crisis are also facing a debt crisis – and the need to service external debt in foreign currency has become a major accelerator of the climate