ActionAid discussion paper on the EU carbon border adjustment

This ActionAid discussion paper seeks to analyse the possible consequences or benefits for developing countries of a carbon border adjustment (CBA) that would be levied on goods imported from outside

Supporting fair tax systems

This report looks at how countries in the global south can mobilise the needed revenues for investments to fight the spread of the COVID-19 pandemic, save lives and protect people's livelihoods.

Extractive Sector Taxation

This progressive tax policy briefing explores how countries can optimize revenues from mining, oil and gas resources, and curb potential revenue loss from extractive industries.

Progressive Taxation Briefings

Progressive taxation means higher tax rates for people who earn or have more wealth and is a clear example of progressivity. The briefings cover generally-regressive taxes that can and should be

Collect more – and more fairly?

Long-term funding is needed in developing countries to provide quality, gender-responsive public services.

Sweet Nothings

Sweet Nothings examines the tax practices of one of the world’s largest food multinationals, the Associated British Foods (ABF) group, in Zambia, one of the most impoverished countries in which it

Mistreated

Women and girls in the world’s poorest countries need strong and effective public services such as schools and hospitals. To pay for this, these countries urgently need to collect more tax revenue.

Making Tax Work for Women's Rights

The fulfilment of women's rights is closely linked to how tax is raised and spent. While there is great potential for tax to bring about positive changes in women's lives, the way that tax policies

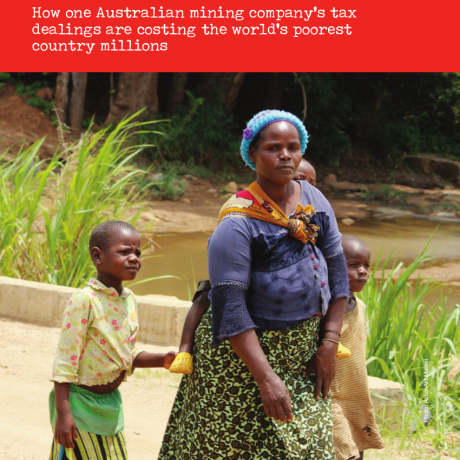

An Extractive Affair

Malawi, the poorest country in the world, has lost out on US$43 million in revenue over the last six years, from a single company: the Australian mining company Paladin. This money has been lost

Stemming the spills

Over the past decade, scandal after scandal has exposed how multinational companies use national tax systems to avoid paying tax in a third country.