Climate-wrecking projects: Did bank AGMs address the elephant in the room?

By Paula Castro

Have you noticed the buzz around the Annual General Meetings or AGMs in the news and on social media and wondered what all the fuss is about?

During these yearly corporate events, investors of public companies – including banks - vote on key decisions for the year ahead and ask direct questions to the decision-makers. Increasingly, civil society has been participating in AGMs to ensure companies are held accountable for their decisions.

But this year as the dust settles on bank AGMs, the world has been left with more questions than answers on the responsibility of these financial institutions towards tackling the climate crisis. Specifically, the AGMs of Citi, HSBC and Barclays have shone a spotlight on banks’ hesitation to stop funding the climate crisis by the billions. ActionAid’s data shows the three banks have been providing a total average of $US26 billion per year to the fossil fuel industry in the Global South since the Paris Agreement was signed.

Despite civil society calling out banks on their continued funding on the climate crisis this AGM season, the banks seem to be continuing with business as usual.

Let me break it down for you:

Firstly, these banks are not addressing the harmful impacts of operations by the companies they provide lending to. They continue to finance companies with demonstrated impacts on frontline and indigenous communities, violating their right to a clean environment, devastating local waterways, livelihoods and people’s health. This is the case of Citibank supporting Petroperú’s contamination in the Peruvian Amazon and Enbridge’s exploiting Indigenous lands with LNG infrastructure in Texas; Barclays supporting fracking companies in Pennsylvania or Citi, HSBC and Barclays all continuously supporting Shell, despite decades of destruction in the Niger Delta.

Secondly, banks are persistently justifying their continued oil and gas investments claiming it is their role to support the energy industry in the transition. However, the International Energy Agency (IEA) has concluded that no new oil-and-gas investment is needed on a 1.5C pathway, suggesting that there is already enough capacity built or under construction to meet demand for the next two decades. Nonetheless, these banks continue to support companies expanding their operations and developing new extraction projects for oil and gas globally, further exacerbating the climate crisis, and harming vulnerable communities on the ground – even when those companies backtrack on their climate commitments, as in the case of TotalEnergies, Shell or BP – which received $US 4.5billion, $US 8.4 billion and $US 6.9 billion, respectively from the three banks between 2015 and 2022.

Thirdly, Citi, HSBC and Barclays have ambitions to provide up to US$1 trillion of sustainable investments by 2030. However, they have not clearly laid out a strategy of how they plan to avoid this simply being greenwashing. For example, both Citi and Barclays took part in sustainability-linked financing to Eni, who has publicly announced plans for fossil fuel expansion designed to increase production and counted it towards their sustainable financing goals. Barclays was also in a similar situation, financing Shell with a $10 billion loan and calling it green, despite Shell rowing back on its climate commitments.

Finally, the banks lack clear granular targets, including clean energy targets and emissions reduction targets related to harmful agribusiness. Strikingly, Citi and HSBC lack any targets on industrial agriculture, while Barclays only focuses on their UK-based investments despite providing $US 11.5 billion to agribusinesses in the Global South during 2015-2022. Research on the broader climate impact of the global food system estimates that it contributes around 30 per cent of the world’s greenhouse gas emissions, being the second source after fossil fuels, and with important negative socio-environmental impacts, such as deforestation and biodiversity loss, water and land pollution, land-grabbing, violation of human and labour rights, and many others.

These AGMs have offered a unique opportunity to spotlight the impact of harmful investments in frontline and Indigenous communities, from South Texas to the Peruvian Amazon, and from Pennsylvania to the Niger Delta. For those affected, these banks have the power to stop supporting companies harming their communities, to demand responsibility for their impacts, and to address their contribution to the climate crisis. Instead, banks continue to respond with vague statements and uncertain commitments with zero consequences for the companies they invest in – and ultimately, for themselves.

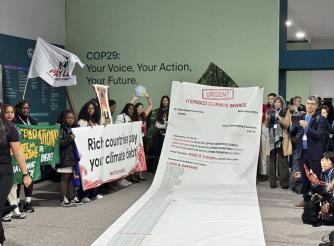

So the fight continues. We need to make sure that the voices, experiences and realities of those most vulnerable to the impacts of the climate crisis and harmful fossil fuel and industrial agriculture are heard in the offices of decision-makers, at the doors of global corporations and in our streets. The financial sector needs to fix the finance and fund our future.

Paula Castro is Policy Adviser on Climate Justice and Corporate Advocacy at ActionAid International

Take Action Now

Together, we can hold banks accountable and demand that they stop funding destruction and start to #FundOurFuture.