Taxing for equality

We see time and again that adequate public services, funded by progressive taxation, are central to levelling out inequality. That means, plain and simple, those with more means contributing

Collect more – and more fairly?

Long-term funding is needed in developing countries to provide quality, gender-responsive public services.

Citizens’ Tax Tribunals

An alternative space to share the stories, generate a debate on the implications of tax on ordinary people and draw the attention of the policymakers.

Campaigning for a more progressive tax system

Our in-depth research and awareness raising on public resource mobilisation in Burundi has led to progressive tax reforms.

A report that opens doors

Our tool that uncovers how European tax policies and treaties might impact developing countries.

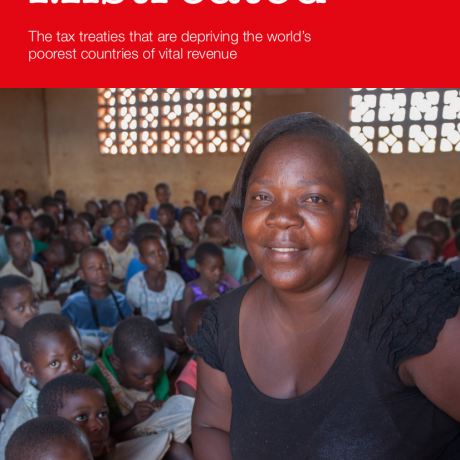

Tax pays for schools

This project led to the mobilisation of local people claiming something in return for their tax payments - namely education.

Fighting taxes that increase inequality

Tax Justice Alliance Uganda challenges a new tax measure that would increase inequality.

New ActionAid research shows stark reality of Covid-19’s impact on young women’s lives in the developing world

ActionAid surveyed 1,219 young women living in urban areas across India, Ghana, Kenya and South Africa revealing lockdown measures have aggravated the pre-existing inequalities they face.

Sweet Nothings

Sweet Nothings examines the tax practices of one of the world’s largest food multinationals, the Associated British Foods (ABF) group, in Zambia, one of the most impoverished countries in which it

Mistreated

Women and girls in the world’s poorest countries need strong and effective public services such as schools and hospitals. To pay for this, these countries urgently need to collect more tax revenue.